When it comes to the Mandatory Provident Fund (MPF) contributions for Hong Kong employees, the rules can get a bit complex, especially for those working outside the territory. Understanding these rules is crucial for both employers and employees to ensure compliance and avoid any legal issues. Let’s break down the key points to help you navigate this area more effectively.

The MPF system is a mandatory retirement savings scheme in Hong Kong, designed to provide financial security for employees in their retirement. Generally, employers are required to make MPF contributions for their employees. However, the situation becomes more nuanced when employees are working outside Hong Kong. The key factor that determines whether MPF contributions are required is the “sufficient connection” between the employee and Hong Kong.

Sufficient Connection: What It Means

A “sufficient connection” is a term used to determine if an employee working outside Hong Kong should still be covered by the MPF system. This connection can be established in several ways:

- Hong Kong Residents Employed from Hong Kong to Work Abroad Temporarily: If a Hong Kong resident is employed from Hong Kong and sent to work abroad for a limited period, the employer must continue to make MPF contributions. For example, if a Hong Kong-based company sends one of its employees to a project in Singapore for six months, the employer must still contribute to the employee’s MPF account.

- Employees Working Outside Hong Kong on a Temporary Basis: If an employee is temporarily working outside Hong Kong, the MPF contributions are still required. This could include short-term assignments or projects that do not involve a permanent transfer. For instance, if a Hong Kong employee is sent to a client site in Japan for a few weeks, the MPF contributions should continue.

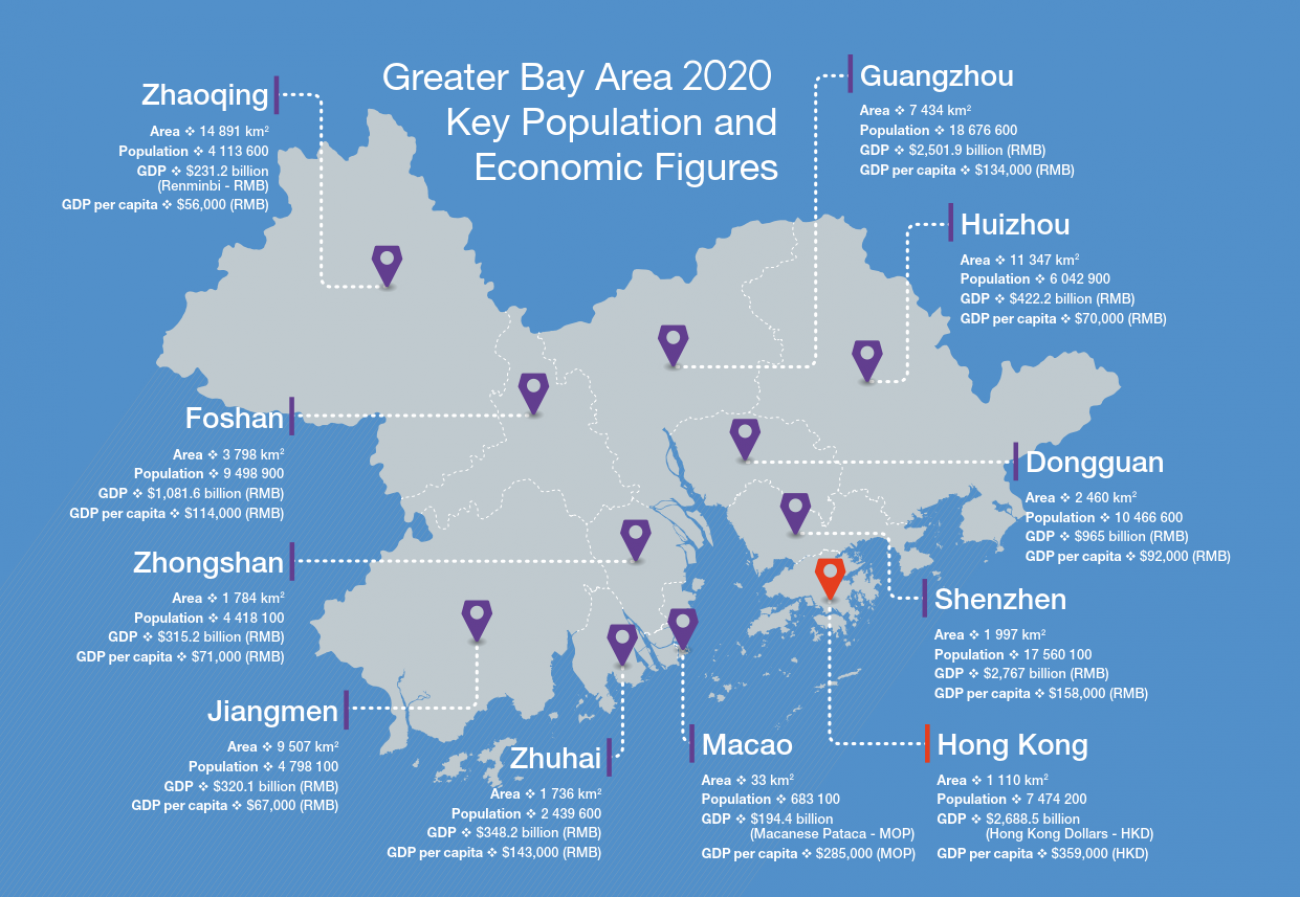

- Employees Residing in Shenzhen and Commuting to Hong Kong Daily: Employees who live in Shenzhen but commute to Hong Kong for work are also covered by the MPF system. This is because their employment is fundamentally based in Hong Kong, even though they reside in a different city. For example, if a Hong Kong company employs someone who lives in Shenzhen but crosses the border daily to work in Hong Kong, the employer must make MPF contributions.

Exceptions to the Rule

Not all employees working outside Hong Kong are covered by the MPF system. There are specific exceptions where MPF contributions are not required:

- Employees Working for Foreign Companies: If an employee is working for a foreign company, even if they are a Hong Kong resident, the MPF contributions are not required. For example, if a Hong Kong resident is employed by a German company and works in Germany, the MPF contributions are not mandatory.

- Employees Employed Outside Hong Kong by an Establishment Outside Hong Kong of a Hong Kong Holding Company: If a Hong Kong holding company has an establishment outside Hong Kong and employs someone there, the MPF contributions are not required. For instance, if a Hong Kong company has a subsidiary in Australia and employs someone in that subsidiary, the MPF contributions are not necessary.

- Employees Employed by a Company Incorporated in Hong Kong but Working Abroad: If a company incorporated in Hong Kong employs someone to work abroad, and the employment is not considered temporary or limited, the MPF contributions are not required. For example, if a Hong Kong company sets up a new office in the United States and hires someone to work there permanently, the MPF contributions are not mandatory.

Seeking Professional Advice

Given the complexity of these rules, it is highly recommended that employers and employees seek professional legal advice if they have any questions or uncertainties. Legal experts can provide tailored guidance based on specific circumstances, ensuring compliance with the MPF regulations and avoiding any potential legal issues.

In summary, the MPF contributions for Hong Kong employees working abroad depend on the “sufficient connection” between the employee and Hong Kong. Employers must make contributions for employees who are Hong Kong residents working abroad temporarily, employees working outside Hong Kong on a temporary basis, and employees residing in Shenzhen and commuting to Hong Kong daily. However, contributions are not required for employees working for foreign companies, employees employed outside Hong Kong by an establishment outside Hong Kong of a Hong Kong holding company, or employees employed by a company incorporated in Hong Kong but working abroad permanently. By understanding these rules and seeking professional advice when needed, employers and employees can ensure they are in compliance with the MPF system.