Elderly Care in Hong Kong: A Consumer Guide

Hong Kong’s aging population has made elderly care a critical issue. With limited space and high living costs, families must navigate complex choices. This guide breaks down key considerations to help you make informed decisions.

Cost of Care

Affordability is a top concern in Hong Kong, where elderly care costs vary widely. Public subsidies exist, but demand often outstrips supply.

- Public vs. Private: Public nursing homes cost HK$1,500–HK$3,000/month (subsidized), while private facilities range from HK$10,000–HK$30,000.

- Home Care: Hourly rates for helpers start at HK$80–HK$150, with live-in maids costing HK$5,000–HK$8,000/month.

- Financial Aid: The Social Welfare Department offers means-tested subsidies for low-income families.

Planning early is essential. Long-term care insurance or savings can bridge gaps in public support.

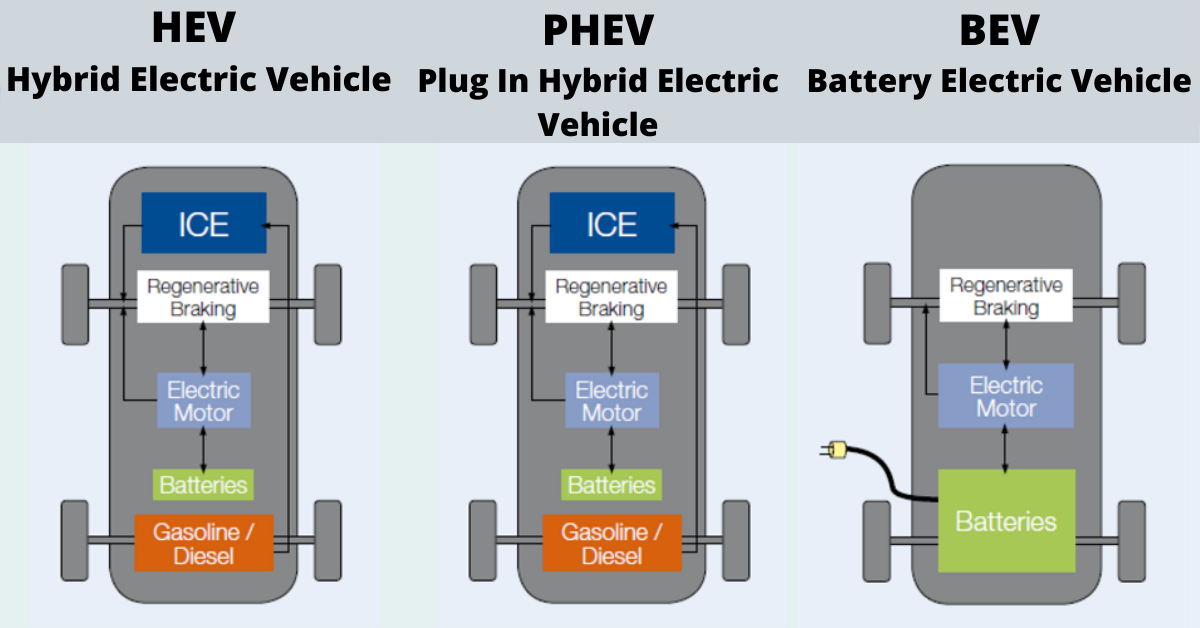

Types of Care

Hong Kong offers diverse options, each suited to different needs and budgets.

- Nursing Homes: Provide 24/7 medical support; best for seniors with severe health issues.

- Day Centers: Cost-effective (HK$1,000–HK$3,000/month) for social activities and basic care.

- Assisted Living: Private apartments with on-call staff (HK$15,000+/month).

Hybrid models, like part-time home care combined with day centers, are gaining popularity.

Quality of Facilities

Hong Kong’s dense urban environment can compromise care standards if unchecked.

- Inspections: Public homes are audited annually; private facilities may lack transparency.

- Staff Training: Look for certifications like NVQ (UK) or local SWD accreditation.

- Safety: Check for grab bars, emergency call systems, and wheelchair access.

Visit facilities unannounced to assess cleanliness and staff responsiveness.

Government Support

Public resources are available but require patience and paperwork.

- Vouchers: The Elderly Commission offers HK$3,000/month for home care services.

- Priority Housing: Subsidized spots are allocated based on health and income.

Private options fill gaps but at higher costs. Compare subsidies with out-of-pocket expenses.

For tailored insurance coverage, consult Navigator Insurance Brokers