Hong Kong is making headlines as a global leader in Web3 innovation, with tokenisation emerging as a defining trend in the digital economy. The recent Consensus Hong Kong 2025 event highlighted the city’s commitment to fostering a thriving Web3 ecosystem, with industry leaders and policymakers discussing the transformative potential of blockchain technology and tokenised assets. But as Hong Kong positions itself as a hub for this digital revolution, the need for robust cyber security and cyber insurance has never been more critical.

Hong Kong’s Web3 Journey: A Brief Overview

Hong Kong’s embrace of Web3 is part of a broader strategy to remain competitive in the global financial landscape. The city has been proactive in creating a regulatory framework that encourages innovation while ensuring investor protection. For example, the Securities and Futures Commission (SFC) has introduced guidelines for tokenised investment products, paving the way for mainstream adoption.

In 2023, HSBC made headlines by launching the HSBC Gold Token, a retail tokenised product that allows investors to own digital gold. This move marked a significant step towards integrating traditional financial assets with blockchain technology. More recently, the Hong Kong government has been actively promoting the city as a hub for Web3, hosting events like the Consensus Hong Kong 2025 to attract global talent and investment.

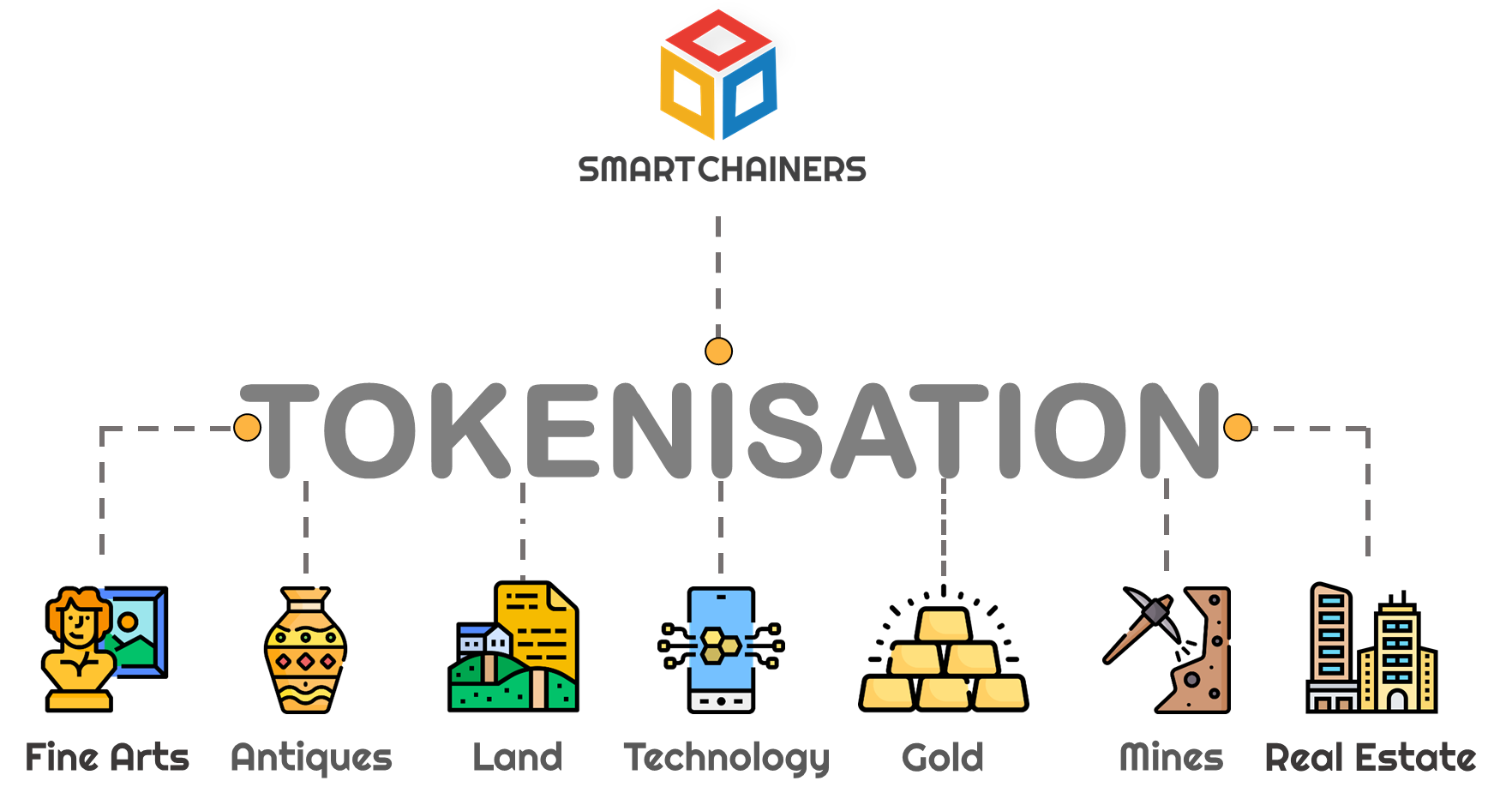

Tokenisation: Opportunities and Risks

Tokenisation, the process of converting real-world assets into digital tokens on a blockchain, offers numerous benefits. It enhances liquidity, reduces transaction costs, and makes assets more accessible to a global audience. For example, tokenised real estate allows fractional ownership, enabling investors to buy shares in high-value properties.

However, with these opportunities come significant risks. Blockchain technology, while inherently secure, is not immune to cyber threats. Hackers are increasingly targeting digital wallets, exchanges, and smart contracts, exploiting vulnerabilities to steal funds or disrupt operations.

The Growing Cyber Threat Landscape

As Hong Kong’s Web3 ecosystem expands, so does its exposure to cyber threats. Recent incidents globally have highlighted the risks associated with digital assets. In 2023, a major decentralised finance (DeFi) platform suffered a breach due to a flaw in its smart contract code, resulting in the theft of over $100 million in assets.

Closer to home, Hong Kong has seen a rise in cyberattacks targeting businesses and individuals. Phishing scams, ransomware attacks, and data breaches are becoming increasingly common, posing a threat to both financial stability and personal privacy.

The Role of Cyber Security and Insurance

In this rapidly evolving digital landscape, cyber security is the first line of defence. Businesses and individuals must adopt best practices such as multi-factor authentication, regular software updates, and employee training to mitigate risks. However, even the most robust security measures cannot guarantee complete protection.

This is where cyber insurance comes in. Cyber insurance provides a safety net, offering financial protection and support in the event of a cyberattack. Here’s why it’s essential:

Financial Protection

Cyberattacks can result in significant financial losses, from stolen funds to business interruption. Cyber insurance helps cover these costs, ensuring a quicker recovery.Legal and Regulatory Support

Data breaches often lead to legal liabilities and regulatory fines. Cyber insurance can cover these expenses, helping businesses comply with Hong Kong’s stringent data protection laws.Incident Response Services

Many policies include access to incident response teams, who can help contain the damage, investigate the breach, and restore normal operations.Coverage for Digital Assets

As tokenisation gains traction, cyber insurance policies are evolving to cover digital assets. This includes protection against theft, fraud, and other risks associated with blockchain-based systems.

Why Hong Kong Needs to Lead in Cyber Security and Insurance

Hong Kong’s ambition to become a global Web3 hub comes with a responsibility to set the standard for cyber security and insurance. By investing in these areas, the city can build trust and confidence among investors, businesses, and individuals.

For example, the government could incentivise the adoption of cyber insurance by offering tax breaks or subsidies to businesses. At the same time, insurers can develop tailored products that address the unique risks of the Web3 ecosystem, such as smart contract vulnerabilities and tokenised asset protection.

Looking Ahead

As Hong Kong continues to lead the way in Web3 innovation, the importance of cyber security and insurance cannot be overstated. Tokenisation and blockchain technology offer immense potential, but they also introduce new risks that require proactive management.

Whether you’re a business exploring tokenised assets or an individual investing in digital gold, it’s crucial to prioritise cyber security and consider cyber insurance as part of your risk management strategy. By doing so, you can protect your digital future and contribute to the growth of Hong Kong’s Web3 ecosystem.