This post is also available in:

简体中文 (Chinese (Simplified))

繁體中文 (Chinese (Traditional))

:max_bytes(150000):strip_icc()/how-are-wisdom-teeth-removed-1059378_FINAL-8a3c2fc6c2c4488499a5c0a25ce7af95.png)

Understanding Wisdom Teeth

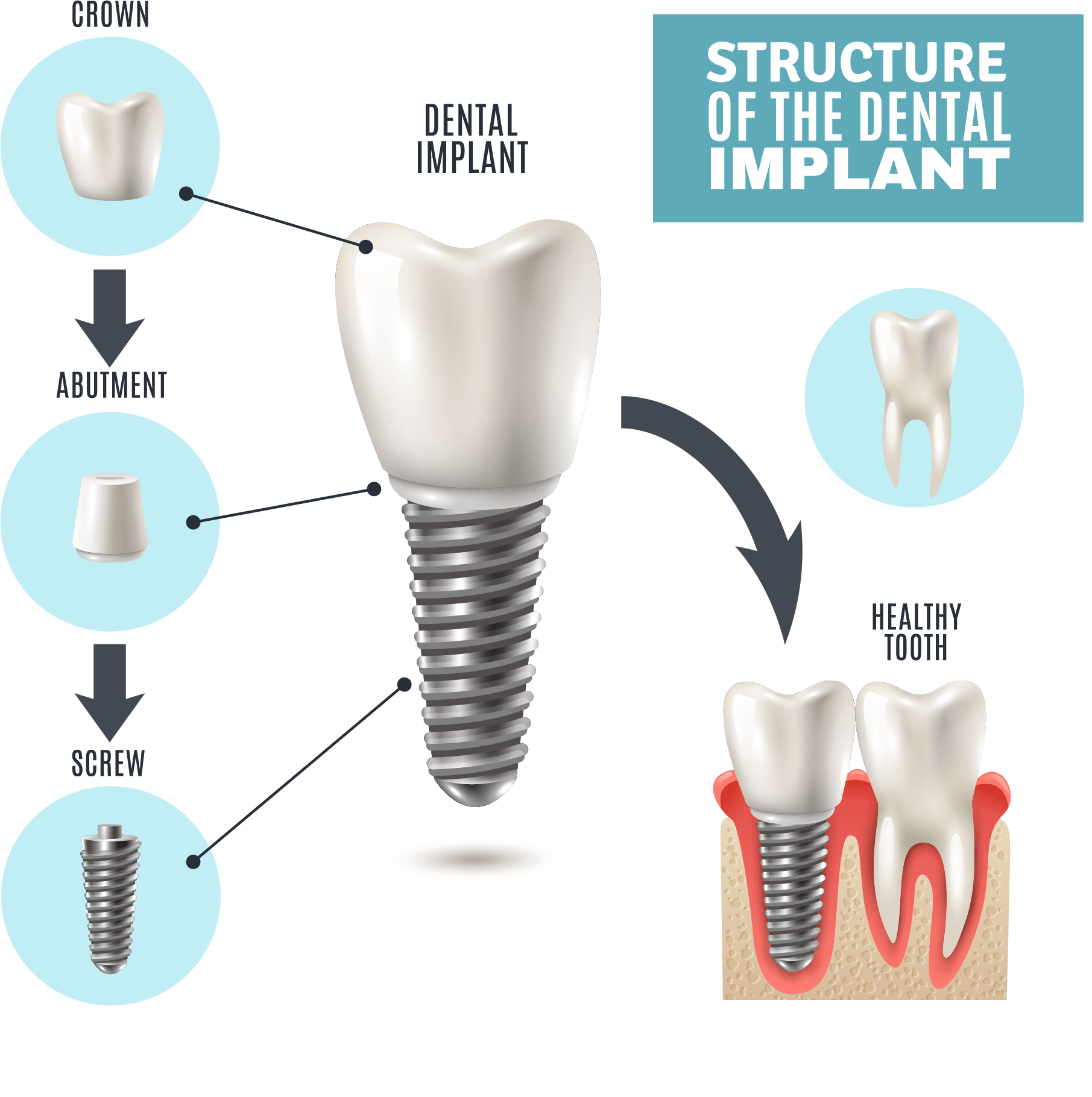

Wisdom teeth are the third set of molars located at the back of your mouth. They usually emerge between the ages of 17 and 25. However, not everyone has enough space in their jaw for these teeth, which can lead to problems. When wisdom teeth don’t have room to grow properly, they can become impacted, meaning they are trapped beneath the gum line or grow at an angle. This can cause pain, swelling, and difficulty opening your mouth.

Regular dental check-ups and X-rays help identify issues early. Dentists use X-rays to see the position of your wisdom teeth and determine if removal is necessary. Ignoring problematic wisdom teeth can lead to serious complications like cysts, gum disease, or damage to nearby teeth.

Why Wisdom Tooth Removal is Necessary

Removing wisdom teeth is often necessary to prevent oral health issues. Impacted wisdom teeth can cause infections, as bacteria can get trapped around the tooth. They can also push against other teeth, leading to overcrowding and misalignment. In some cases, cysts or tumors can form around impacted wisdom teeth, damaging the jawbone and surrounding teeth.

Early removal is key to avoiding these problems. Dentists recommend removal before the roots of the wisdom teeth fully develop, which makes the procedure easier and reduces recovery time.

Dental Insurance Coverage for Wisdom Tooth Removal

Dental insurance helps cover the cost of wisdom tooth removal, but coverage varies by plan. Most plans categorize wisdom tooth removal as a major procedure, which typically covers 50% to 80% of the cost after deductibles and co-pays. For example, if the procedure costs $1,000 and your plan covers 50%, you would pay $500 out-of-pocket.

It’s important to review your policy for specific details. Some plans may require pre-authorization, meaning your dentist must confirm the procedure is necessary before insurance will cover it. Additionally, age restrictions may apply, as many plans only cover removal for individuals between 16 and 25.

Types of Dental Insurance Plans

There are three main types of dental insurance plans: PPO, HMO, and indemnity plans.

- PPO (Preferred Provider Organization) plans allow you to choose any dentist but offer lower costs if you use a dentist within the plan’s network.

- HMO (Health Maintenance Organization) plans require you to use a dentist within the network and often have lower premiums but less flexibility.

- Indemnity plans let you visit any dentist and reimburse a percentage of the cost after you pay upfront.

Each plan type has different coverage levels for wisdom tooth removal, so compare options to find the best fit for your needs.

Exclusions and Limitations in Dental Insurance Coverage

Dental insurance policies often have exclusions and limitations. For example, some plans may not cover wisdom tooth removal if it’s considered cosmetic or if the patient is outside the typical age range (16-25). Pre-existing conditions, such as infections caused by wisdom teeth, may also affect coverage.

Review your policy carefully to understand what’s included and what’s not. If your plan has limitations, consider alternative options like dental savings plans or payment arrangements with your dentist.

Alternatives to Dental Insurance for Wisdom Tooth Removal

If you don’t have dental insurance, there are other ways to manage the cost of wisdom tooth removal. Dental savings plans offer discounted rates for procedures, while payment plans allow you to spread the cost over time. Community health clinics and dental schools often provide affordable services, though availability may vary.

Comparing costs and exploring multiple options can help you find the most cost-effective solution.

Tips for Maximizing Dental Insurance Benefits

To get the most out of your dental insurance, follow these tips:

1. Review your policy to understand coverage details, including deductibles, co-pays, and maximum limits.

2. Schedule the procedure within the policy year to avoid losing unused benefits.

3. Use pre-authorization to confirm coverage before the procedure.

4. Negotiate costs with your dentist or dental office.

5. Maintain regular check-ups to catch issues early and avoid costly procedures later.

By taking these steps, you can minimize out-of-pocket expenses and make the most of your dental insurance.