Building Insurance

Building insurance is a critical protection for property owners in Hong Kong, covering the physical structure of buildings—including walls, roofs, and permanent fixtures—against risks such as natural disasters (e.g., typhoons, landslides), fire, vandalism, and accidental damage. In a densely populated, high-rise city prone to extreme weather and urban hazards, this insurance is essential for mitigating financial losses and ensuring the safety of residents and property assets. It is often required by mortgage lenders, providing financial security and reducing the burden of costly repairs or legal liabilities.

For property owners, landlords, and management companies, building insurance offers peace of mind and resilience against unforeseen events. Key considerations include ensuring comprehensive coverage, accurately assessing the sum insured to reflect rebuilding costs, and understanding policy exclusions such as wear and tear. By investing in a robust policy, stakeholders can protect their investments and maintain the safety and stability of their properties in Hong Kong’s challenging environment.

Saving You Time & Money While Shopping For Insurance

Get Free Insurance Quotes

Fill out our inquiry form, and we'll identify the perfect policy to suit your requirements and lifestyle.

Emergency Hotline: +852 2530 2530

Building Insurance Insights

Rebuilding Cost vs. Market Value

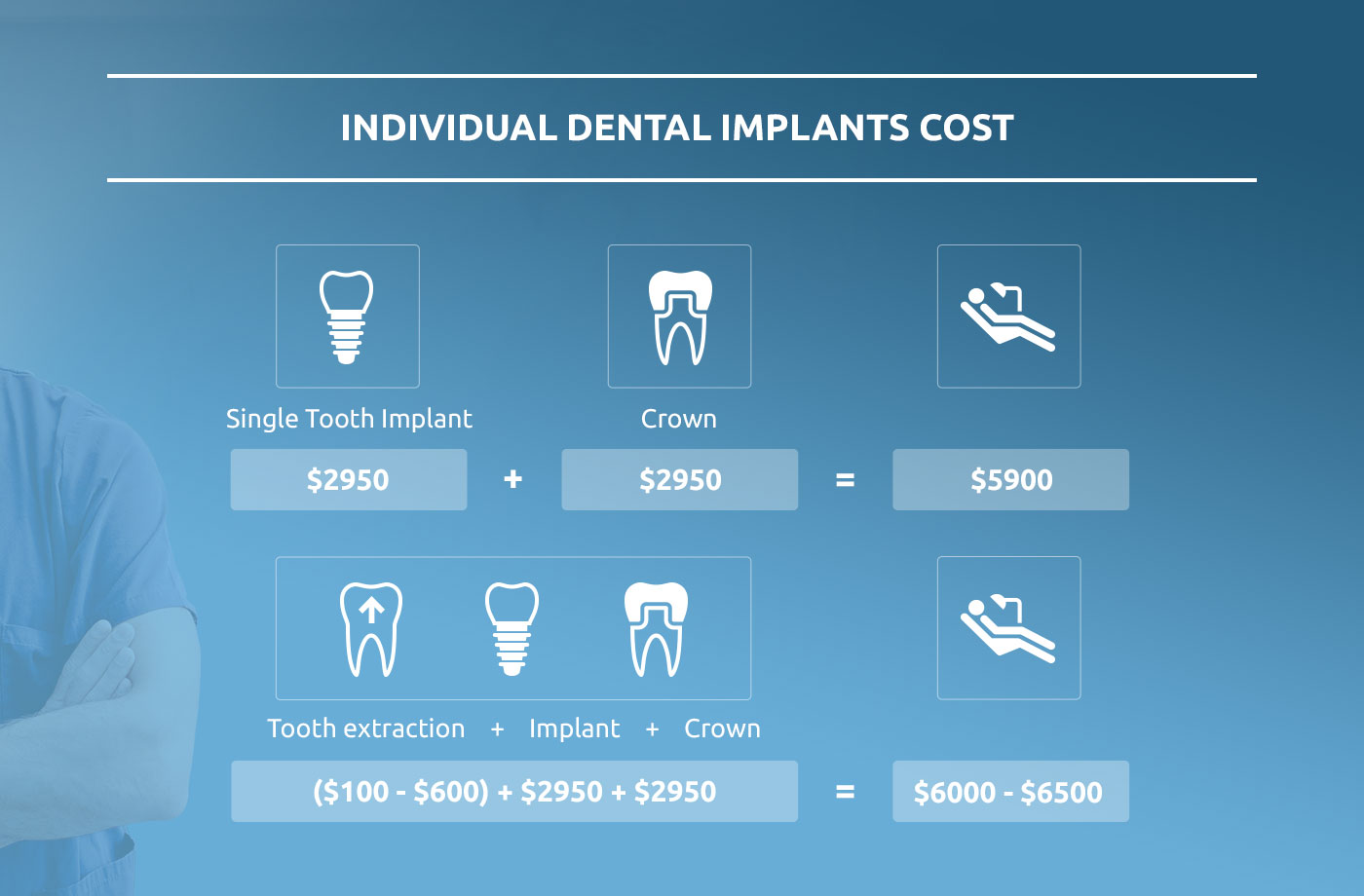

When determining the sum insured, it’s crucial to base it on the rebuilding cost of the property, not its market value. The rebuilding cost includes materials, labor, and professional fees required to reconstruct the building, which can differ significantly from the property’s sale price. Underinsuring can lead to insufficient coverage, while overinsuring results in higher premiums unnecessarily.

Natural Disaster Coverage

Given Hong Kong’s susceptibility to typhoons, flooding, and landslides, it’s essential to ensure the policy includes coverage for natural disasters. Some policies may exclude or limit such events, leaving property owners vulnerable to significant financial losses during extreme weather conditions.

Third-Party Liability

Building insurance often includes public liability coverage, protecting property owners against claims for injury or property damage suffered by third parties on the premises. This is particularly important in densely populated areas or shared spaces, where accidents or damage to neighboring properties could result in costly legal disputes.

Building Insurance FAQs

Building insurance generally covers the physical structure of a property (e.g., walls, roofs, permanent fixtures) against risks like fire, natural disasters (e.g., typhoons, landslides), vandalism, and accidental damage. Some policies may also include public liability coverage for third-party injury or property damage claims.

While building insurance is not legally required, it is often a condition for obtaining a mortgage, as lenders want to protect their investment. Additionally, it is highly recommended for property owners to safeguard against unforeseen events and financial losses.

The sum insured should be based on the rebuilding cost of the property, which includes materials, labor, and professional fees for reconstruction, rather than its market value. Underestimating the rebuilding cost can lead to insufficient coverage, while overestimating results in unnecessarily high premiums.

Many policies cover natural disasters such as typhoons, flooding, and landslides, but this varies by insurer. It’s crucial to review the policy details to ensure adequate coverage for Hong Kong’s extreme weather conditions, as some policies may exclude or limit such events.

Common exclusions include wear and tear, damage caused by poor maintenance, intentional acts by the property owner, and events like war or nuclear hazards. Some policies may also exclude specific natural disasters or require additional riders for full coverage.

No, building insurance is tied to the property owner rather than the property itself. When selling, the new owner must secure their own policy. However, sellers should ensure the property remains insured until the transfer is complete to avoid gaps in coverage.