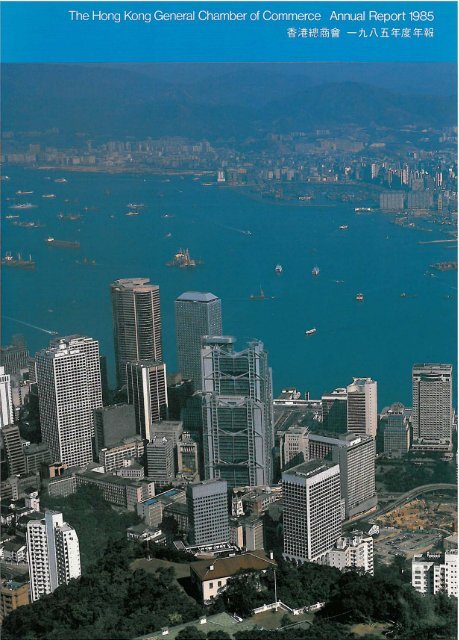

Travel Insurance

Travel insurance is a vital safety net for Hong Kong residents and visitors embarking on journeys near or far. Whether you’re planning a weekend getaway to Southeast Asia, a business trip to Europe, or an adventure across continents, travel insurance offers financial protection and peace of mind against unexpected events like medical emergencies, trip cancellations, or lost luggage.

Travel insurance has become an essential companion for wanderers. Tailored to cover diverse needs, from single-trip policies to annual plans for frequent travelers, it ensures you’re prepared for the unpredictable, allowing you to focus on making memories.

Saving You Time & Money While Shopping For Insurance

Get Free Insurance Quotes

Fill out our inquiry form, and we'll identify the perfect policy to suit your requirements and lifestyle.

Emergency Hotline: +852 2530 2530

Travel Insurance Insights

Medical Coverage is a Priority

With healthcare costs soaring overseas (e.g., a hospital stay in the U.S. can exceed HKD 50,000), comprehensive medical coverage is a top consideration for Hongkongers purchasing travel insurance.

Customizable Plans for Diverse Travelers

Insurers in Hong Kong offer tailored options—solo travelers, families, seniors, or adventure enthusiasts can find policies covering everything from flight delays to extreme sports mishaps.

Digital Convenience

Many insurers now provide instant online quotes and claims processing, aligning with Hong Kong’s tech-forward population, making it easier than ever to secure coverage before takeoff.

Travel Insurance FAQs

Travel insurance in Hong Kong usually includes medical expenses, trip cancellation or interruption, lost or delayed baggage, and personal liability. Some plans also cover travel delays or emergency evacuation, depending on the policy.

Yes, even for short trips, travel insurance is recommended. Unexpected events like flight cancellations or minor medical issues can occur, and costs can add up quickly without coverage—especially in countries with higher healthcare fees.

Costs vary based on trip duration, destination, and coverage level. A basic single-trip policy for a week in Asia might start at HKD 100-200, while annual plans for frequent travelers can range from HKD 800-2,000.

Most insurers in Hong Kong require you to purchase travel insurance before departure. Buying it mid-trip is usually not allowed, so plan ahead to ensure coverage.

It depends on the policy. Some insurers offer coverage for pre-existing conditions with additional premiums or specific terms, while others exclude them. Always check the fine print or consult your provider.

Contact your insurer immediately via their hotline or app, provide necessary documentation (e.g., receipts, medical reports), and submit your claim within the specified timeframe—typically 30 days after the incident.

Standard policies may not cover high-risk activities. You’ll need to opt for additional coverage or a specialized adventure travel plan if you’re engaging in sports or extreme activities.